An out-of-pocket maximum is a cap, or limit, on the amount of money you have to pay for covered health care services in a plan year. If you meet that limit, your health plan will pay 100% of all covered health care costs for the rest of the plan year. Some health insurance plans call this an out-of-pocket limit. A plan year is the 12 months between the date your coverage is effective and the date your coverage ends.

- What you pay toward your plan’s deductible, coinsurance and copays are all applied to your out-of-pocket max. Once you reach your out-of-pocket max, your plan pays 100 percent of the allowed amount for covered services. If your plan covers more than one person, you may have a family out-of-pocket max and individual out-of-pocket maximums.

- Out-of-pocket maximum is the most you could pay for covered medical expenses in a year. This amount includes money you spend on deductibles, copays, and coinsurance. Once you reach your annual out-of-pocket maximum, your health plan will pay your covered medical and prescription costs for the rest of.

- An out of pocket maximum is the set amount of money you will have to pay in a year on covered medical expenses. In most health insurance coverage, there is no copayment for covered medical services after you have met your out of pocket maximum. All plans are different, though, so ensure you pay attention to plan details when buying a plan.

An out of pocket maximum is the predetermined amount of money you will have to pay annually on covered medical costs. In many plans, there is no copayment for covered medical services after you have met your out of pocket maximum. All plans are different, though, so be sure to pay attention to plan details when purchasing a plan.

If you have dependents on your plan, you could have individual out-of-pocket maximums and a family out-of-pocket maximum. This depends on the terms of the plan.

How does an out-of-pocket maximum work?

Costs you pay for covered health care services count toward your out-of-pocket maximum. This may include costs that go toward your plan deductible and your coinsurance. It may also include any copays you owe when you visit doctors.

Here’s an example of how an out-of-pocket maximum might work, depending on the health plan:

- Jane Q. has a health plan with a $2,500 deductible, 20% coinsurance, and a $4,000 out-of-pocket maximum.

- At the start of her plan year she has an unexpected illness. She sees her regular doctor and a number of specialists. She goes through a lot of medical tests.

- She receives medical bills totaling $2,500 and pays these costs. This meets her deductible. Since she pays this money out of her own pocket, it also counts toward her out-of-pocket maximum.

- She continues to see specialists regularly and has to have another round of tests.

- She pays 20% coinsurance as her share of these medical costs, while her health plan pays the other 80%. Her bills amount to $1,500. This also counts toward the out-of-pocket max.

- At this point, Jane has spent a total of $4,000 and has met her out-of-pocket maximum.

- Now, her health plan will begin to pay 100% of her costs for covered care for the rest of the plan year.

What types of health care expenses count toward an out-of-pocket maximum?

The following are health care expenses that are often applied to an out-of-pocket maximum:

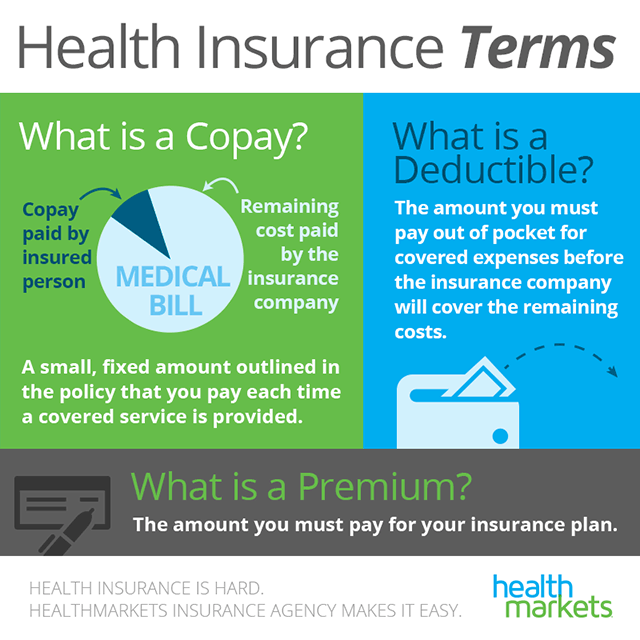

- Deductible: These are costs you pay out of your own pocket that go toward your deductible. Since most plans cover all costs for preventive care, these costs are typically for covered in-network care that is not preventive. Some plans may not allow your deductible to count toward the out-of-pocket maximum. Check your plan details.

- Coinsurance: Once you meet your deductible, your health plan kicks in to share costs with you. This is your coinsurance. Your share of these costs also goes toward meeting your out-of-pocket max.

Are there any expenses that don’t count toward an out-of-pocket maximum?

There are a number of expenses that may not count toward the out-of-pocket maximum:

- Care and services that aren’t covered: Your health plan may not cover some types of services. This could include things like cosmetic treatments, weight loss surgery, and some alternative medicine.

- Costs above the allowed amount: Most plans set an allowed amount for various services. If a doctor or facility charges more than that, your plan is not going to cover that cost. This means it will not be applied to your out-of-pocket maximum, either. Make sure to check the details of your plan.

- Out-of-network care and services: Most health plans have a network of doctors. These doctors agree to give plan customers discounted rates for using their services. If you go to doctors or facilities that do not participate in your plan’s network, your costs may not be covered.* What you pay for out-of-network care may not be applied to your out-of-pocket maximum. It’s important to ensure providers are in your plan’s network before seeing them.

- Plan premiums: If you buy a health plan on your own and not through your employer you typically have a monthly plan premium. This cost doesn’t count toward your out-of-pocket maximum.

- Most preventive care: Many health plans cover most preventive care at 100%, as part of the Affordable Care Act (ACA). This is routine care like an annual check-up, some lab tests, flu shots and some other vaccinations, and routine screenings like an annual mammogram and colonoscopy. These preventive services are paid for by your health plan, so their costs do not count toward the out-of-pocket maximum.

- Plan deductibles (in some cases): For some health plans the out-of-pocket max may not include costs that go toward your deductible. Make sure you understand the details of your health plan when choosing coverage.

Do all health plans have an out-of-pocket maximum?

Copay After Out Of Pocket Maximum

Plans that meet Affordable Care Act (ACA) standards are required to have out-of-pocket maximums. As the health insurance industry changes, there could be non-ACA plans that do not meet the same standards.

What’s the difference between an individual and family out-of-pocket maximum?

Health plans that cover more than one person on a plan often have individual out-of-pocket maximums, as well as a family out-of-pocket max.

- Individual out-of-pocket maximum: If someone on the plan reaches their individual out-of-pocket max, the plan starts paying 100% of their covered care for the rest of the plan year. Any expenses individuals pay also go toward meeting the family out-of-pocket max.

- Family out-of-pocket maximum: Out-of-pocket costs for each individual go toward meeting the family out-of-pocket maximum. This may include costs for deductibles, coinsurance, and copays. If the family out-of-pocket maximum is met, the plan takes over paying 100% of everyone’s covered costs for the rest of the plan year.

Copay And Out Of Pocket Maximum

If you buy a plan on your own and not through an employer, there are set limits for these out-of-pocket maximums. This is part of the Affordable Care Act.**

Do most people meet their out-of-pocket maximum?

How you use your health plan and what you need coverage for both matter when it comes to meeting your out-of-pocket maximum:

Aca Out Of Pocket Maximum

- If you’re generally healthy and only get your annual check-up, you may not even meet your deductible. Your health plan pays for most preventive care, so you’d have few costs.

- If you need a lot of medical care that’s not routine then your medical bills could add up. In this case, it’s possible you could reach your out-of-pocket maximum.

The out-of-pocket maximum is the most you’ll pay in a plan year before your plan starts covering your care. It’s important to understand how an out-of-pocket maximum works with the rest of your health plan, including the deductible, coinsurance, and copay. When choosing a health plan, make sure you consider all these factors, as well as your expected health needs. Games page 4watermelon gaming.

Out Of Pocket Maximum Cover Copays

*Unless it’s a true emergency medical condition as defined by your plan.